Why invest with us?

Our unique approach to investing incorporates findings from academic and Nobel-prize winning research. It is sophisticated, yet straightforward. Our approach to investing is in sharp contrast to the traditional practices seen in today’s financial services industry. We believe that successful investment management starts with a clear understanding of the purpose of investing and the application of investment theory that is validated by empirical observation.

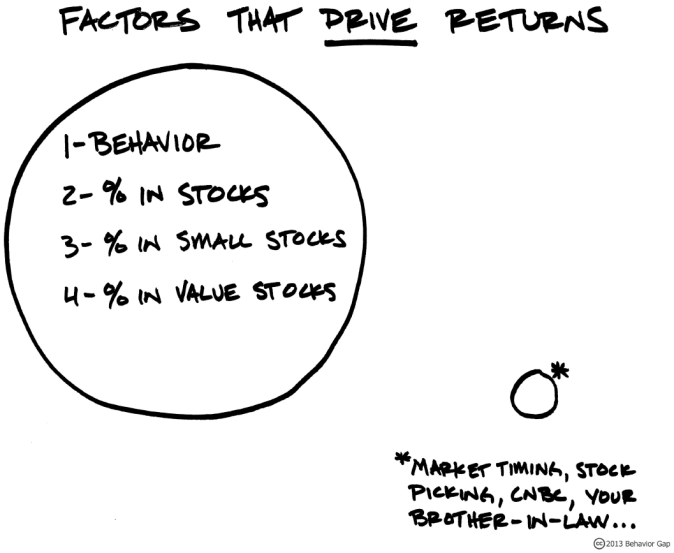

Behavioral Finance

We value evidence over emotion.

Behavioral psychologists have identified various behaviors that cause investors to act in sometimes irrational ways. The most important determinant of realized returns comes from the ability to adhere to your carefully constructed investment plan. Keeping emotional responses to a minimum plays a key role in the investment process.

Modern-Portfolio Theory

We value decades of academic research over and above the empty, often wildly fluctuating opinions that dominate the financial news.

The basis for the principles in your investment plan is a collection of the best evidence from the academic disciplines of economics and finance. Investment experts usually summarize this evidence as Modern Portfolio Theory (MPT).

MPT has four basic concepts:

- Markets process information so rapidly when determining security prices that it is extremely difficult to gain a competitive edge by exploiting market anomalies.

- Over time, riskier assets provide higher expected returns as compensation to investors for accepting greater risk.

- Adding high risk, low-correlating asset classes to a portfolio can actually reduce volatility and increase expected rates of return.

- Passive asset class fund portfolios can be designed with the expectation of delivering over time the highest expected returns for a chosen level of risk.

Our approach provides for a prudent, fully diversified, cost conscious, performance measured methodology. The American Law Institute, in drafting the Uniform Prudent Investor Rule (which has been adopted by most states as the foundation for their prudent investor rules), stated the following:

- MPT is adopted as the standard by which fiduciaries must invest funds.

- Economic evidence shows that the major capital markets are highly efficient.

- Investors are faced with potent evidence that the application of expertise, investigation and diligence in efforts to “beat the market” ordinarily promises little or no payoff after taking into account research and transaction costs.